A 3D revolution in Africa?

Start your APP China – Africa Additive Manufacturing?

For bloggers, agents, collaborators about China – Africa 3D Printing

A challenge to manage China – Africa or Latin America – Africa 3D?

virtually due to our crossing system in order to make money together with us.

For example choose niches as Shanghai – West Africa 3D Printing, Argentina – Nigeria Laser Printers, Mexico – SA reasonable Industry 4.0, Beijing – East Africa 3D APPS, Colombia – ECOWAS Start up your APP, etc etc.

Good ideas about Addivtive Manufacturing for Africa? Any Project for your African country in mind? Your ideas means money in Sylodium.

contacts us here info@sylodium.com

For companies and institutions in China - Africa or LATAM – Africa bilateral trade.

Our logical business system, allows you to segment your target markets to be seen, and dominate the bilateral trade niches you choose

For ex.: www.ChinaAfrica.mobi , www.LatinamericaAfrica.mobi

as starting point, as our URLs, metas and contents do the rest, due to all of them are well ordered in the real way to be the unique platform that represent (and reproduce) the reality of international business in Internet.

Additive manufacturing: Implications for African economies

New from HowWeMadeItInAfrica.com

US$15.5tn in 2016, according to World Trade Organisation (WTO) data, is expected to shrink by at least half over the next half century due to 3D printing or additive manufacturing (AM). In tandem would be global value chains (GVCs), which were set to give African countries perhaps their last fighting chance at industrialisation. At $346bn in 2016, African merchandise exports were just 2% of the world total. And 32% of these were oil exports.

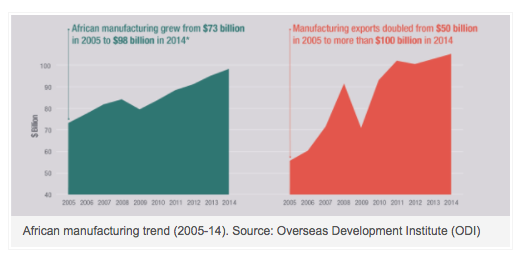

Still, African manufacturing has actually been on the ascendancy, growing in real terms by 3.5% a year to $157bn in 2014, up from $73bn in 2005, with exports doubling to more than $100bn in the period.

African manufacturing trend (2005-14). Source: Overseas Development Institute (ODI)

Manufacturing more and better with less

With automation and 3D printing, high-wage developed economies may no longer be in much need for manufacturers, whether as intermediates or finished goods, from African and other low-wage countries. Short of raw material constraints, any country would in the not-to-far distant future be able to virtually manufacture any good using a 3D printer. And if advances in 3D printing proceed as currently envisaged, it would be possible to do so at about or more than the current speed of traditional manufacturing processes. When that is the case, in about four decades from now, at least according to recent research by ING, a Dutch bank, there might not be that much need for labour-intensive manufacturing, the type African countries need to keep their teeming idle youth populations constructively engaged.

ING’s report suggests about a quarter of world trade could be wiped out by 2060 on the back of advances in 3D printing, especially in car manufacturing. Incidentally, this was the type of manufacturing that African countries were banking on and have actually been recording some progress with. A Chinese-backed car assembly plant in South Africa is expected to start exporting cars in early 2018, for instance. As the first new car plant in South Africa in at least forty years, it represents an expected trend of that kind of manufacturing moving to relatively lower-wage economies from an increasingly pricey Chinese labour market; even though the South African labour market is amongst the most expensive and disruptive on the African continent.

China’s evolution is a typical example with its manufacturing jobs moving to other Asian countries

Industrialisation in Africa

Do African countries still have a chance to industrialise then? Put another way, do they need to? In addressing the question, the time left for any such development must first be countenanced. So, as earlier highlighted, 3D printing would likely become advanced enough to cut international trade by half in about 40 years’ time. That is still a long time in any country’s development. So yes, African countries still have a chance to industrialise and yes, they still need to. But in doing so, they must begin to position themselves to ensure that the acquired competencies could be easily upgraded to ensure relevance in the envisaged future of manufacturing expected to be dominated by automation and 3D printing.

The smile curve depicting value distribution along a GVC. Source: OECD

But unlike more adaptable technologies in sectors like telecommunications, where in the absence of legacy encumbrances, African countries have been able to leapfrog to mobile telephony and internet technologies from hitherto backward and dysfunctional telecommunication infrastructure, manufacturing and industry are not so easily adaptable or replicable. In the current context, for instance, an African country could not suddenly be able to produce industrial robots or 3D printers or innovate fast enough to compete with advanced economies that are already way ahead. The current and likely future model for developing countries is that these innovations would be procured from such economies. But without an already robust industrial base and a workforce easily upskilled, such as is the case in China, the potential economic gains from such an adaptation could still be a net negative.

Even so, it is not impossible that some 3D printing technologies could emanate from developing countries, including Africa (or be readily accessible to them). But it is almost certain the advanced ones would only be available to them subject to the discretion of authorities in the countries of the original equipment manufacturers (OEMs).

But there is progress up north as well. In October 2017, Elephab, a Nigerian replacement and emergency parts additive manufacturer, secured funding from an American venture capital firm. It already has continental ambitions, pointing to likely innovation from multiple sources within the continent. Noteworthy though is that the 3D printers to be used by the Nigerian example are to be procured from Germany and the US. So, to that extent, South Africa is more advanced.

It helps of course that South African universities already teach the subject; a wide knowledge gap is one of the other major constraints holding back additive manufacturing in general. African countries could leverage on South Africa’s growing expertise to leapfrog into additive manufacturing as well. What is clear, though, is that there would be something that may still put currently advanced economies ahead, raising the barrier to entry. The emerging scenario is that most African countries would necessarily procure their 3D printers from America and Europe, now and in the future. If African countries must stand a chance then, they would need to protect their markets.

Plug into GVCs where it matters

What is the extent of Africa’s stake then? About 2.2% in 2011, from 1.4% in 1995. And smaller African countries like Lesotho, Mauritius, the Seychelles, Swaziland, and Tanzania are more plugged into international production networks, among the top-30 participating countries in GVCs. Incidentally, what additive manufacturing portends for even that meagre African participation in GVCs, is quite dire. With an estimated one-billion-strong workforce by 2040, and expectedly more about the time 3D printing is expected to overcome earlier highlighted constraints, and potentially render redundant precisely the type of labour-intensive manufacturing that has long been envisioned would be used to put that labour force to work, the dangers to global security and peace could best be imagined.

Lack of jobs at home is the primary reason young Africans brave stormy seas to illegally migrate to Europe and almost anywhere else outside the African continent. Thus, unless African governments begin to plan for how this many people would find work, value-adding ones at that, they are likely to have a major crisis on their hands. With new production technologies, robotics and 3D printing already engendering so-called “re-shoring”, whereby globally dispersed labour-intensive production stages of GVCs in low-wage economies are increasingly now being returned to what hitherto were considered high-wage headquarter countries.

Focus on global value chains in the services sector

The foreign content of the exports of developed countries are expected to decline as 3D printing makes high-wage economies competitive again, thereby reducing the need for them to manufacture intermediates and/or assembly finished goods in low-wage economies. This would dash the hopes of low-wage African countries looking to attract cost efficiency-seeking manufacturing foreign direct investment (FDI). Not that there were not already sharp wage disparities between African countries, meaning the impression of homogeneity of cheap wages is somewhat misplaced. Average wages in Kenya of $2,854 are more than three times those in Ethiopia of $807, where the pace of industrial development is quicker.

The author, Dr Rafiq Raji,

Artificial Intelligence - 21/02/2018

Artificial Intelligence - 07/02/2018

Artificial Intelligence - 15/12/2017

Artificial Intelligence - 27/11/2017