Kenyans carry the burden of China's high cost loans

Do you have any idea about mini projects (not big as this one) to help to reduce the gap with African countries?

Tell us about it,

and work with us to make money as blogger.

This new from Standard Digital

Kenyans carry the burden of China's high cost loans

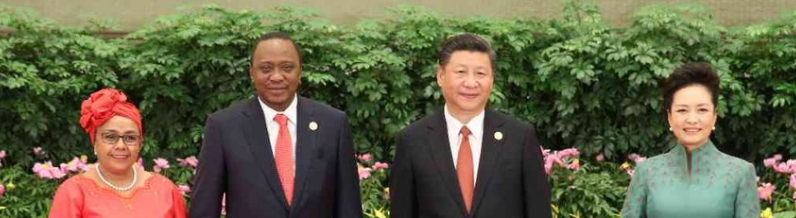

President Uhuru Kenyatta might have signed a contract with Beijing that will see you labour for China in years to come. On his visit to Beijing last week for the One Belt One Road (OBOR) forum, Uhuru secured Sh362 billion from the Asian superpower for the extension of the standard gauge railway (SGR) from Naivasha to Kisumu.

It was a deal that will tighten China’s grip on the Kenyan economy. Uhuru is also reported to have requested for another Sh16 billion for the construction of the Western Bypass. With the cash, credit for the SGR alone will rise to Sh1 trillion while total public debt will hit Sh4 trillion, burdening KenyansEconomic activities Already, for every shilling Kenya pays as debt, 23 cents is swallowed up by China.

This means a significant portion of your hard-earned cash that would have gone to building more development and welfare projects is instead being channelled to Chinese coffers. Although China’s financing of infrastructure has been touted as Africa’s silver bullet to economic progress, it has taken up at a fast pace — even as the recipient countries continue to struggle with revenue mobilisation. In Kenya, for example, China’s debt levels dramatically shot up in 2015 after inking the SGR deal, essentially making China its biggest bilateral lender ahead of Japan, Germany and France. Moreover, with its no-strings-attached policy on lending (unlike the West which pegs support on issues such as transparency and accountability), China’s big money might be offering an opportunity for the corrupt to mint billions, denying Kenyans value for their money. “At the end of the day, long-term infrastructure financing will work when the assets are well managed and risk has been accurately assessed,” said Martyn Davies, the managing director in charge of Emerging Markets and Africa at audit firm Deloitte.

Indeed, the real cost of the SGR and whether Kenyans got value for their money remains highly contentious. Bloomberg economist for Middle East and Africa Mark Bohlund says infrastructural projects being built all over the country will be critical in opening up the urban centres. And with the towns opened and buzzing with economic activities, the Government will easily repay the debts used to build the modern railway line. While this seems definite for the many roads being constructed by the Chinese, it is debatable with the SGR. Its viability has come into sharp focus with the World Bank questioning the financial value of the project in a 2013 report.

The key issue is whether there will be enough capacity to keep the railway running. “Investment in standard gauge appears only to be justified if the new infrastructure could attract additional freight in the order of 20 to 55 million tonnes per year,” said the report titled, The Economics of Rail Gauge in the East Africa Community. ALSO READ: Views: Are Jubilee’s trade deals binding on the next government? An article in the British magazine, The Economist, also raised concerns with the project.

“Repaying the loans taken out to build the line will require hefty fees or huge volumes of traffic. But truckers—who now handle more than 95 per cent of the freight moved from Mombasa port—will compete fiercely on price, and shipping companies may look for other ports if levies rise,” it said. Projects fail Indeed, sometimes the Chinese projects fail, forcing taxpayers to either dig deeper into their pockets or default and not lose opportunities for essential capital. This was recently the case with Kazakhstan. On Thursday, the United Nations raised the red flag over the economic, social, financial and economic risks of China’s One Belt One Road (OBOR) project.

“External account indicators for some of these economies are relatively weak. In Kazakhstan, the current account deficit amounted to six per cent of GDP in 2016 while external debt stood at over 80 per cent of GDP in 2015,” said the UN Economic and Social Commission for Asia and the Pacific. “Relatively easy access to large foreign loans for infrastructure projects, even if most of them tend to be on concessional basis, can lead to risks through deterioration in trade balance, undermining macroeconomic and balance of payments stability in small economies,” it said.

Global Ratings agency Fitch also last week warned that China’s generosity is just but an effort to extend its global influence and relieve domestic capacity. ALSO READ: Clear your loans, legislators told “There is a risk that projects might not be aimed at addressing the most pressing infrastructure needs and could fail to deliver expected returns,” it said. In Sri Lanka, Mattala Rajapaska International Airport is one of the white elephant projects constructed using Chinese money.

Built at a cost of $209 million (Sh21 billion) with features such as a 12,000 square-metre terminal building, 12 check-in counters and a runway long enough to handle the largest commercial jets, it only handles two flights a day. Saddled with debt, the country is now considering converting some of the loans it owes China into equity. Prof Samuel Nyandemo of the University of Nairobi’s School of Economics refers to China’s projects as debt trap diplomacy. “Extending loans for infrastructure projects is a good thing. But look at the projects being funded. Most of them are meant to open markets for Chinese goods in strategically-located countries and increase their access to natural resources,” he told Weekend Business.

“If there is one thing China is truly good at, it is using its economic assets to advance its geostrategic interests, which has left countries snared in a debt trap that makes them vulnerable to Chinese influence,” said Prof Nyandemo.

By the end of last year, Kenya owed China Sh313 billion, or 57 per cent of the total amount owed to other countries, after a three-year surge that saw the Asian tiger overtake Japan as the largest creditor in 2015. During that year alone, Chinese debt tripled from Sh80 billion to Sh252 billion. ALSO READ: India skips China's Silk Road summit, warns of 'unsustainable' debt In the last four years, Kenya has accumulated Sh276 billion debt from China. President Mwai Kibaki started the dance with the dragon with his Look-East policy, though Uhuru’s tango with the Chinese has been more vigorous.

Back in 2008, Kenya got its first taste of Chinese largesse when the Asian superpower agreed to lend the coalition government $84 million to construct the Eastern and Northern bypasses. Within two years, another $156 million was received to fund the Southern bypass and another Sh46 billion for Thika road. There was something appealing about Chinese money, something that made not just Kenya but most African countries accept it with such zeal. It was not the cost of the capital, said Dr Davies. “It is its rapid deployment and ability to align and rally contracting construction firms to roll out the necessary infrastructure in the recipient country,” he said.

However, Jubilee administration’s appetite for Chinese debt has been insatiable.

The Government has accumulated, since it came into power five years ago, slightly over Sh2 trillion in debt. Uhuru is on record having said that debt should not be an issue as long as it is being put to good use.

The Government puts on a brave face when questioned about the trade imbalance between the two countries and has used every opportunity to insist that Kenyans are getting what they deserve in their relationship with China. However, on the sidelines of the OBOR conference in Beijing two weeks ago, Uhuru told international magazine Financial Times that China should do more to correct an “increasingly skewed relationship with Africa.” “As with any country, the trade deficit is an issue of concern and we will be pushing to see how we can increase opportunities for Kenyan goods to penetrate the Chinese market,” he said.

It is not only China’s money being poured into Nairobi; there are also more Chinese products than ever before. Critics have said China’s influence on the continent is not fundamentally different from that of European colonisers more than 50 years ago.

With the sovereign debt coming from State-owned Exim Bank, the projects are given to Chinese firms, and in the case of the SGR they will also operated the rail services. Capture market Mr Bohlund says Kenya will continue to receive Chinese financing because it is part of the OBOR — or what management firm McKinsey has described as “the world’s first trade superhighway.” OBOR, or the silk road, consists of a physical road and shipping lane. It is part of China’s “Going Out” policy that was launched in the 1990s and which emphasises the acquisition of natural resources, capture of foreign markets and building global Chinese brands. While Africans see this as a way of connecting the continent, the Chinese see it as a way of penetrating and exploiting the African continent.

Davies says that while the mega Chinese projects “are undoubtedly economically enabling and thus developmental in nature” they are also “arguably displacing of local construction players.” Critics argue that unlike Western countries which transferred much of their technology to the Chinese when they poured into the Asian country, China has not done the same in Africa. United Nations Conference on Trade and Development Secretary General Mukhisa Kituyi says it is time for Africa to smell the coffee and start looking for alternative ways to finance its development budget.