Mobile games market rising in Africa

FOR BLOGGERS and PARTNERS

Do you want to manage mobile games Industry between Russia MENA and rest of Africa?

or your African country in mobile games industry?

Contact us here, mayado@sylodium.com for be our blogger managing Russia - Middle East – Africa mobile games industry, so managing all the niches related you choose: Ghana – Russia gamification, Nigeria apps games, SA – Ukraine mobile games, Africa – GCC videogames, etc, etc, endeless related

Another option is being our collaborator in your African country if you consider as a good thinker, visionary, hard studious, you can become our blogger or our partner in Nigeria, Tanzania, South Africa, Egypt in relationship with Russia, any former Soviet country, or any MENA country…. contact us. mayado@sylodium.com

FOR COMPANIES AND INSTITUTIONS:

Tap our unique Crossing System. SYLODIUM: the business language

Mobile games market rising stars: New promising countries in terms of revenues

new from PocketGamer.biz

he process of creating a mobile game takes a significant amount of time for planning, designing and fixing.

But when it comes to choosing the primary distribution markets, it all becomes more apparent. Western publishers traditionally release in to the West (the US, the UK, Canada, Germany, France, Australia, etc.), and Eastern publishers to the “East” (China, Japan, South Korea, Taiwan, etc.).

All the countries mentioned above have something common - the huge revenue.

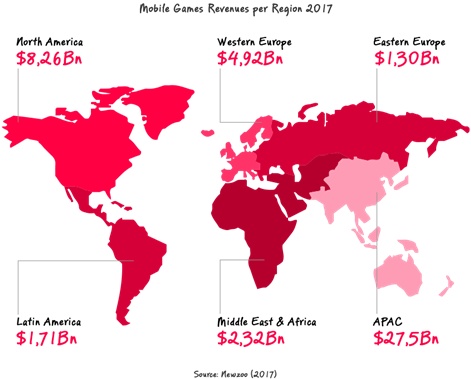

At the moment, China is an absolute leader of the mobile games market with $10 billion of revenues in 2016, with North America, Japan, and Western Europe going right after China with total revenues of $18 billion dollars as of 2016.

But what about emerging markets? And what is important to bear in mind while choosing a new promising market to launch your mobile game in? Let’s take a look.

1. Revenues

It’s not a secret that most publishers keep in mind the possibilities of getting high profits and positive ROI when choosing the right markets for their mobile games.

Usually the prime choice is English-speaking countries (United States, Canada, the UK, Australia, New Zealand), and it’s no wonder: these countries are the some of the most profitable and, at the same time, it takes less effort for developer to release here, as there's no need for localisation and it’s a safer bet. These markets are well explored and the culture is similar.

Switching from the Western market to the Eastern market, it’s easy to emphasise China, Japan and South Korea for their tremendous revenues, which make up most of the APAC region's mobile games earnings.

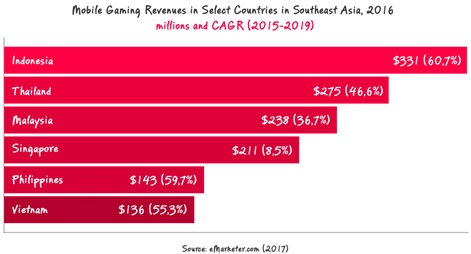

Without these three countries, APAC is hardly able to outperform North America and Western Europe. But it’s only a matter of time before these countries grow. Southeast Asia is the one of the world’s fastest growing mobile games regions in terms of revenues, which are growing with an astonishing CAGR (2015 to 2019) of +45.3%, well above the global average of +14.6%.

This region is also known for the high level of engagement among local players and the huge number of new players.

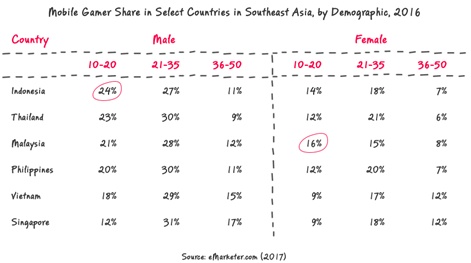

Young mobile gamers are a major reason for the rapid rise in revenues in the region. In Indonesia, for instance, the difference between male players aged 10 to 20 and 21 to 35 is only 3%, while in Malaysia the number of the young female players is the largest among all age groups.

Another important factor driving mobile game spending in Southeast Asia is how often people play. Gamers in the region often play mobile games daily, providing games makers with plenty of opportunities to cross-promote new titles and upsell existing customers on new game features.

Mobile revenues for the entire Southeast Asia region reached a mark of $1.5 billion in 2016, with about 95% coming from the “big six” countries: Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam.

Rapid growth in these six countries over the coming years will lead to revenues of $3.9 billion by 2019, as was forecasted by Newzoo.

Among this “big six”, Indonesia is the fastest growing and largest Southeast Asia market in terms of revenues. Singapore is the smallest mobile market in the region in terms of gamers, but has the fourth largest revenues ($211 million) due to a very high average spend per paying gamer of $226.

LATAM (Latin America), consisting of Brazil, Mexico and Argentina as the main mobile markets in the region, is the second-fastest-growing region in the world after Southeast Asia.

The mobile games market in Latin America has grown from $0.9 billion in revenues in 2015 to $1.4 billion in 2016 and, at the moment, and the games market is predicted to grow to $3 billion in 2019, accounting for 48% of the gaming market in the region.

Last year, while PC and console gaming took up the majority of the market, 77% of paying console players in Argentina and 64% in Mexico were also spending money on mobile games, pushing mobile games up further.

Compared to such huge Asian mobile games markets like China and Japan, there is a much higher English proficiency in SEA, especially since it’s the official language of Singapore and the Philippines.

But it's not the same everywhere: according to the EF EPI, Thailand still demonstrates very low English proficiency, while Indonesia, the largest SEA market, only has moderate proficiency. So localisation in these countries really makes sense.

As for localisation in LATAM, it should be mentioned that European Spanish (español) and Latin American Spanish (castellano) have many differences, so localising two Spanish versions will be a good idea, considering that the LATAM mobile games market is bigger than Spanish mobile games market itself.

Localising games in the MEA region means a lot, especially in the Gulf Cooperation Council (GCC) countries. At the moment, the absolute leader of the Arab mobile games market is Revenge of Sultans (انتقام السلاطين).

Despite the fact that this game effectively the same as Game of War and made not by an Arabic games company, but by Chinese one - it’s performing much better there than the original. The main factor here is a full immersion into local history, customs and, of course, the presence of the Arabic language.

7. Conclusion

In 2013, when the US mobile games market was almost a four times bigger than the Chinese market, it was hard to imagine that just in few years China will overtake the market leader and become the new world’s largest mobile gaming market.

Who knows where the next mobile gaming "Sangrail" will be? In the meantime, game developers are able to get the most out of the new and very promising games markets such as SEA, LATAM, and MEA thanks to the following advantages:

- In most cases, low barriers for joining the market.

- These markets are fast developing, so you have a good chance for achieving high profits in future, if you entering these markets at the moment.

- Your main competitors in other markets might be absent there.

- The prospect of further rapid growth.